Using a budget spreadsheet is a very hands-on method of budgeting. This type of template is perfect for individuals that like complete control and are great with numbers. If you love looking at the numbers and tracking every last penny, then a Google Sheets budget spreadsheet will be perfect for you.

#Business monthly expenses template free

Google Sheets has plenty of budget templates and spreadsheets to choose from, and unlike Microsoft Office, it’s free with your Gmail account. Of course, Google never lets you down with its products and services! Google Sheets Budget Spreadsheet Template You can head here to grab our FREE budget template now.

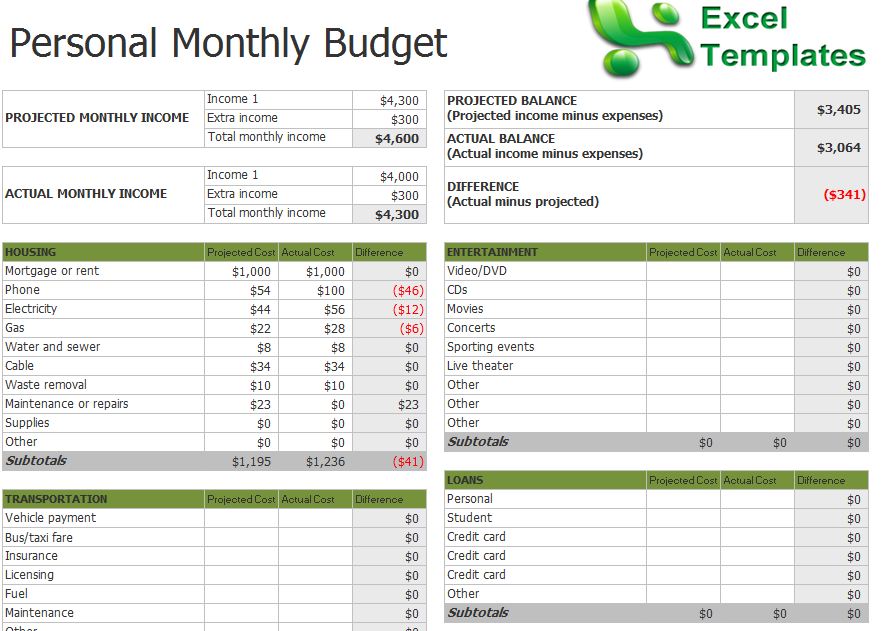

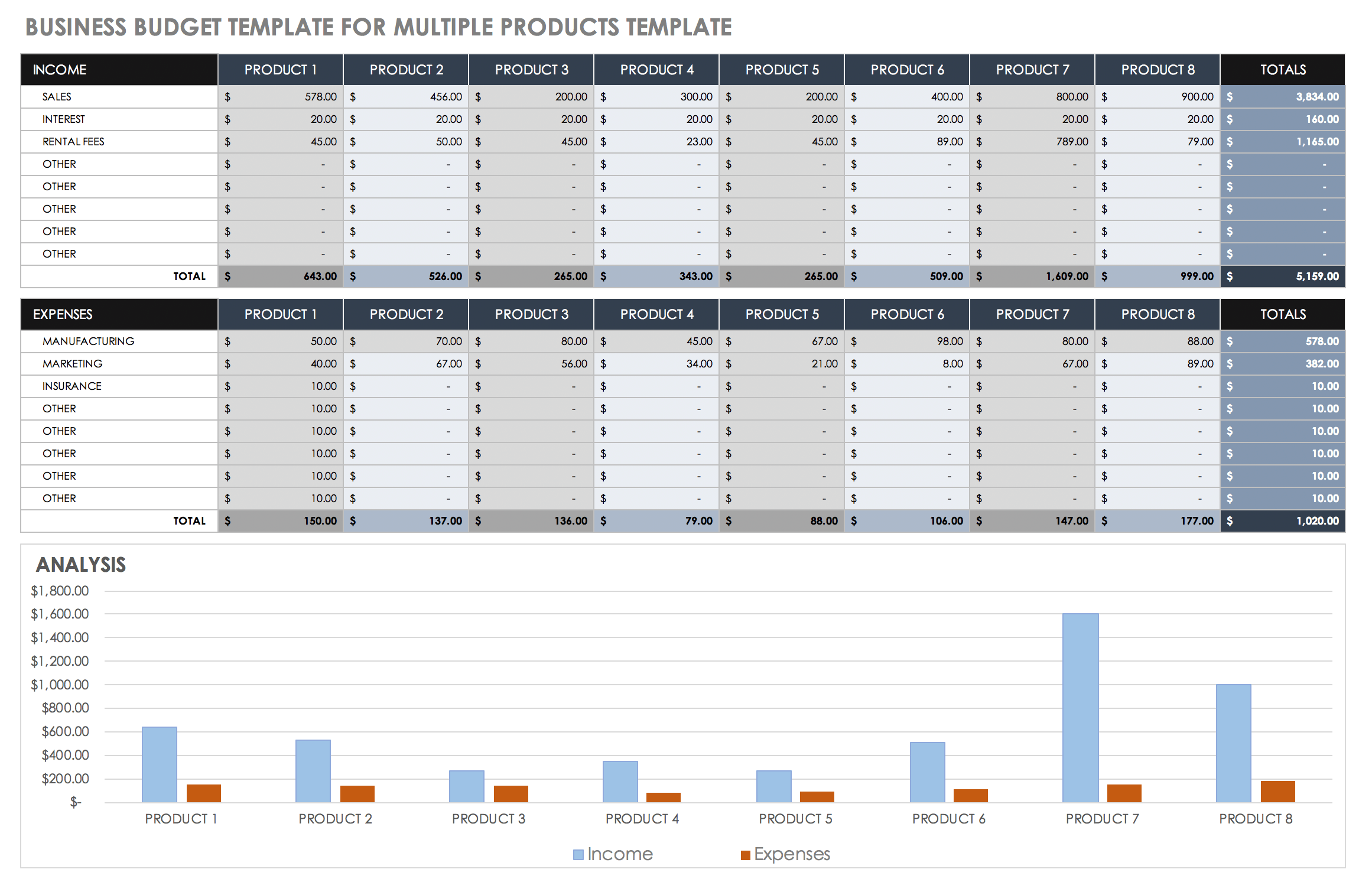

We found when you are first getting started with a monthly budget, nothing beats pen and paper, hence why we made a whole budget planner and some templates for you! We even have a meal plan templateas well.Īdd your income at the top then subtract your fixed costs, variable expenses, debt, and savings then watch our digital budget auto-calculate your monthly cash flow at the bottom. Our free template is both printable as a budget worksheet and digitally like a spreadsheet that will auto-calculate for you. You can customize and use it for any financial situation! A budget will give you insight as to whether you’re managing the business to your expectations and projections.We created our FREE simple budget template to be as straightforward and easy to use as possible. A business plan can provide the foundation for what your business is and how it should be run. At that point, you may have few options to remedy the situation.įor business owners, information is the key to making informed decisions. If you don’t have a budget, you may not realize that you need to cut back on certain costs until it’s too late. Reviewing the budget regularly will allow you to make these changes before they become serious problems. That could mean cutting hours for employees, reducing marketing expenses, or buying less inventory. However, if you consistently run over budget in the same category every month, it might be time to examine that area and make cost reductions. It may be that your business had a large, one-time expense in a given month. You may need to reassess whether your projections are realistic or make operational changes in the business in future months.Īlso be sure to ask yourself why there were significant differences. When reviewing the budget, look for areas where the actual results differ significantly from the projections. Doing it any more frequently may not provide you with enough information to make informed decisions. Most business experts recommend reviewing the budget on a monthly basis. While creating a budget is a good first step, the budget itself is meaningless if you don’t review it on a regular basis. How often should a business budget be reviewed? Having an updated budget also shows lenders and investors that you possess a certain level of organization and competence as a business manager and make you more trustworthy in their eyes. Lenders may want to see your budget to get an idea of how well you control costs and whether your operations are profitable. Running a business without a budget is akin to taking a long road trip without a map or GPS.Ī budget is also important for conveying your business’s performance to others. A budget can tell you whether your business’s revenues are meeting projections, if costs are getting out of hand and which expenses need to be reigned in. The most important reason to have a budget is to gain a deeper understanding of your business.

This allows you to compare the two numbers for insight into how your business is performing. The budget should also have two columns next to each category and subcategory. Variable costs change with sale volume and include things like the cost of goods, labor, and shipping. Fixed costs are costs that don’t change with sales volume and include things like rent, utilities, and insurance. Expenses are generally split between fixed and variable costs. Total those revenue subcategories to calculate an overall revenue figure.Įxpenses are typically broken down to a very specific level. In the revenue category, you may want to see revenue for specific product lines or specific store locations. The revenue and expense categories can be broken down into more specific subcategories. Although budgets can be set up in many different ways, every budget should follow the same basic formula of: Every budget should be broken down into three general categories: revenue, expenses, and profit. Much like a personal budget or a household budget, a budget for business keeps track of income and costs.

#Business monthly expenses template download

NOTE: scroll down to the end of this article to download a complimentary excel file including a budget template for you to use What is a business budget?

Business Budget Essentials – Preparation and Review

0 kommentar(er)

0 kommentar(er)